Khotin at Zenit - billions in Cyprus?

Could Alexey Khotin and Zenit Bank withdraw Tatneft’s money on a failed development project in the Istra urban district of the Moscow Region ?.jpg?v1714192123)

As the UtroNews correspondent reports, Sberbank AST has put up for sale four plots of 71.5 hectares in the village of Obushkovskoye, Istra urban district, Moscow region. The seller is three organizations - Obushkovo LLC, Red Village LLC and New Jerusalem LLC. However, their total credit debt significantly exceeds this amount.

As our publication managed to find out, earlier a large development project was implemented on these sites with the involvement of credit funds from Zenit Bank, which belonged to the state-owned Tatneft. This money could be withdrawn from the project in the interests of the scandalous banker Alexei Khotin.

Plots lead to offshore Khotin?

In 2013, the Finnish company Lemminkäinen (Lemminkäinen Stroy LLC, previously built an ice arena in Kazan) announced the start of a large development project in the Istra district, the construction of 46 low-rise residential buildings using Finnish technology, cozy and environmentally friendly. The implementation period was set for 2016, the customer was Microdistrict Country, the technical customer was TSK-Management LLC, and the main creditor was Zenit Bank, which is part of the business circuit of Tatneft State Corporation.

The implementation of the first stage was carried out by the Finnish Lemminkäinen. But it didn’t go any further. Subsequently, this company was absorbed by the Finnish concern YIT and left the project. After that, YIT bought out Etalon Group of Companies, then entered Vladimir Yevtushenkov’s AFK Sistema.

The plots were originally recorded on Lakeland LLC, the current sellers of the legal successors of this organization. It is behind her that the interests of banker Alexei Khotin can stand.

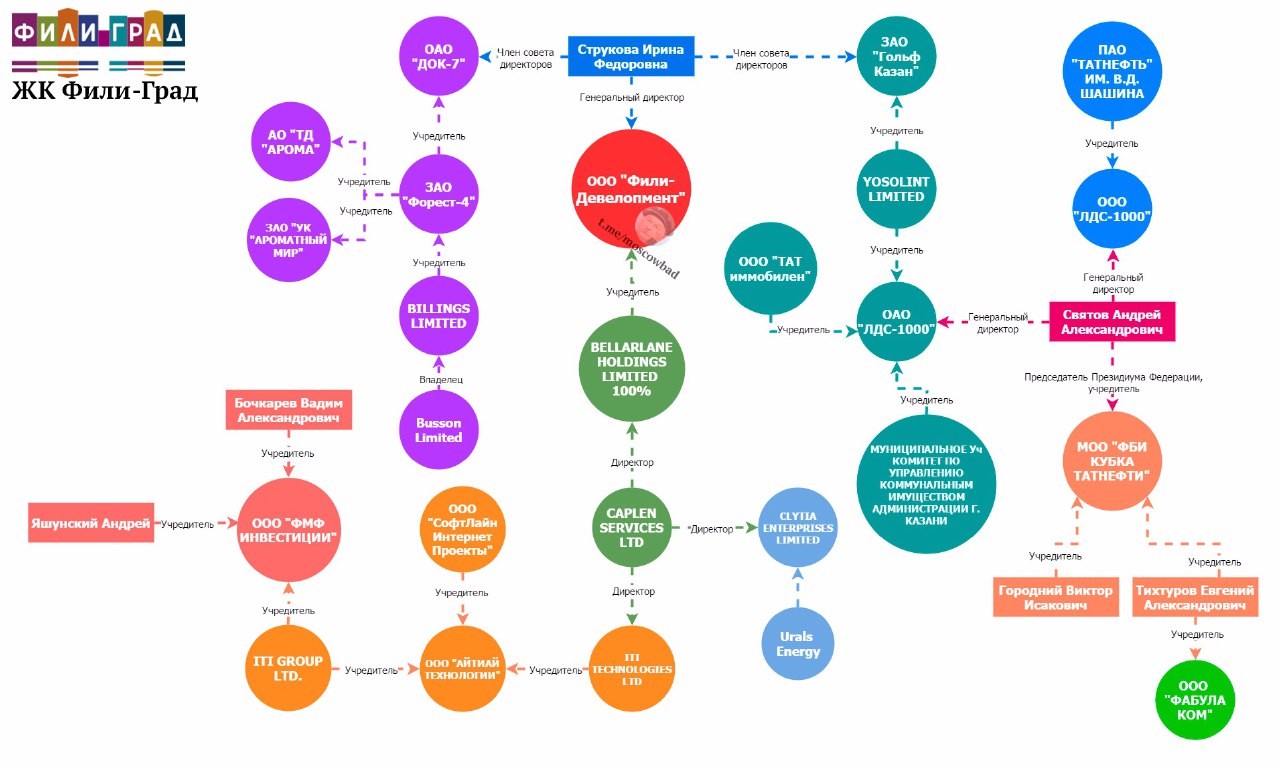

The founder of Lakeland is Olga Varlamova. She was also the general director of CJSC Fili Development, where 99% belonged to the Cypriot offshore BELLARLANE HOLDINGS LIMITED and another 1% to Igor Fetisov. In 2015, i.e. just when the development project in Istra "stood up," the structure was reorganized into an LLC, in which BELLARLEIN already owns 100%.

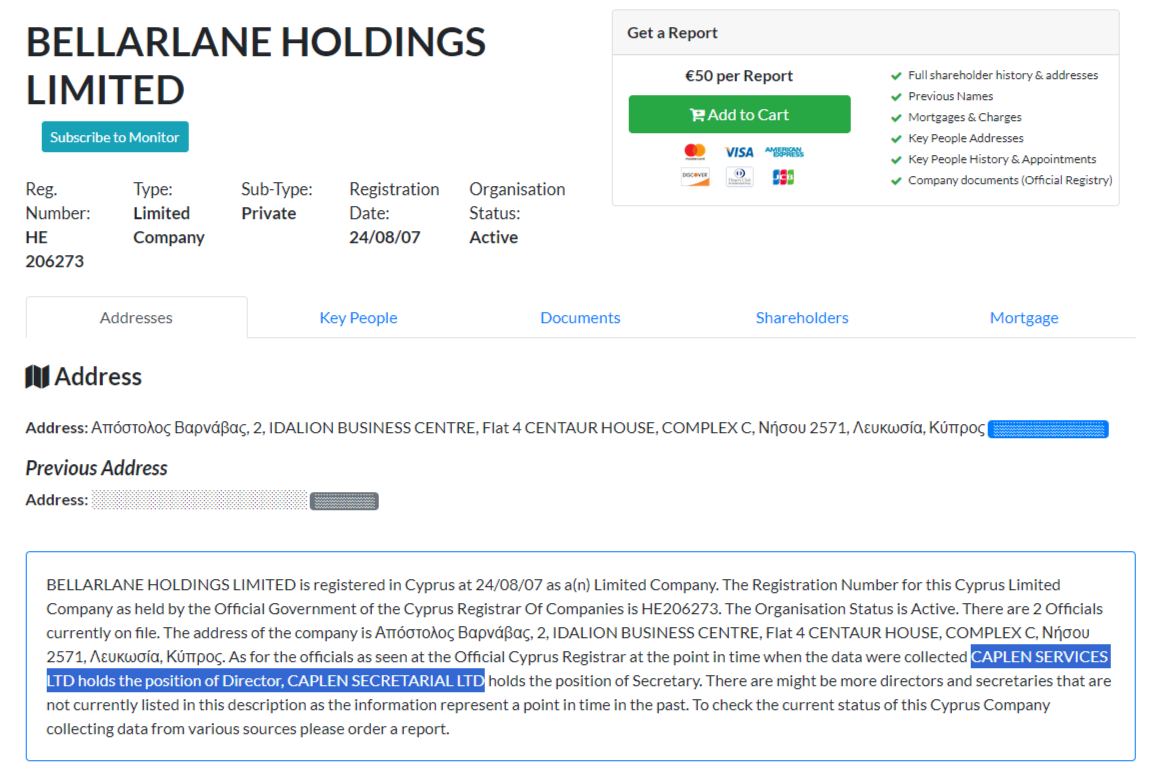

Photo: https://cyprusregistry.com/companies/HE/206273

According to the Cyprus Register of Legal Entities, BELLARLANE HOLDINGS LIMITED is managed by CAPLEN SERVICES LTD. The same structure manages two more offshore companies: CLYTIA ENTERPRISES LIMITED and ITI TECHNOLOGIES LTD.

The beneficiary of CLYTIA ENTERPRISES LIMITED may be the oligarch Alexey Khotin. Previously, the same offshore was related to the oil-producing group Urals Energy. Back in 2005, a subsidiary of Tatneft (then the main beneficiary of Zenit) sold about 27% of the bank to Urals Energy. And in 2010, this company was bought for debts by the bank "Ugra" Alexei Khotin - it became the basis for his own oil company "Dulisma" (subsequently confiscated).

Photo: https://telegra.ph/Kto-i-kak-unichtozhaet-poslednij-zelenyj-rajon-11-13

It turns out that Alexey Khotin, on the one hand, could act as the real owner of land plots in the Istra region. At the same time, according to the network, allegedly these sites could be obtained illegally due to corruption in the team of the new mayor of Moscow at that time Sergei Sobyanin.

On the other hand, Khotin himself was the beneficiary of Zenit, which operated, among other things, with state money from Tatneft. So much for the cycle of budget money in nature. Do you need to look for them in Cyprus now?

And the oligarch himself, we recall, is now in big trouble. In March, he was sentenced to nine years in prison for embezzling 17.3 billion rubles from depositors of his Yugra bank. His assets were confiscated. True, they have already been stolen.

If it turns out that Alexei Khotin could be involved in a possible scam with the alleged theft of funds from Zenit Bank, he may again be convicted, and the total term of imprisonment will be much longer.

Other "stakeholders"

Lakeland LLC was liquidated in 2015, almost simultaneously with the reorganization of Fili Development. Its successor was Obushkovo LLC, Krasny Poselok LLC and New Jerusalem LLC, where land plots and multibillion-dollar debts remained. And Olga Varlamova turned out to have nothing to do with it.

Subsequently, these sites were combined with the project of the already erected Sampo residential complex. At the same time, the land is not liquid - judging by the fact that they have been trying to sell plots of 71.5 hectares for several years.

MC LCD "Sampo" - LLC "UK Braus," founder Margarita Soboleva. She is the former director of Zenit Leasing LLC of Zenit Bank. Obviously, a credit and financial institution could put its own person to look after the sale of debtors’ property.

Perhaps, against this background, the Criminal Code decided to earn extra money. Earlier, a report was published on federal TV about the situation in Sampo, where the Braus management company allegedly limited the residents of the complex - they cannot call a taxi to the house, order courier delivery, they simply do not let anyone in without passes. And in order to get this pass, you have to pay 2.5 thousand rubles to the Criminal Code, allegedly to pay land tax. People just refuse to pay. And it is clear why, it seems like they are trying to hang up the land tax of the sold land. Just the above three companies did not pay tax in 2023.

Video: YouTube channel https://www.youtube.com/watch?v=DLQuDwI3hjE

Returning to the owners of the plots - the debts there are huge. The value of Obushkino’s assets is minus 68 million rubles with accounts payable of 1.8 billion rubles. Debts of the "Red Village" -735 million rubles with an asset value of minus 14 million rubles; "New Jerusalem" - 1.2 billion rubles. As for the developer of the complex, Microdistrict Country, the value of its assets is minus 1.6 billion rubles, accounts payable - 3.3 billion rubles. The losses of the latter at the end of 2023 exceeded half a billion rubles.

Thus, the total accounts payable of the four companies related to the project exceeds 7 billion rubles against the lot price of 3.8 billion rubles. Where did another 3.2 billion rubles go?

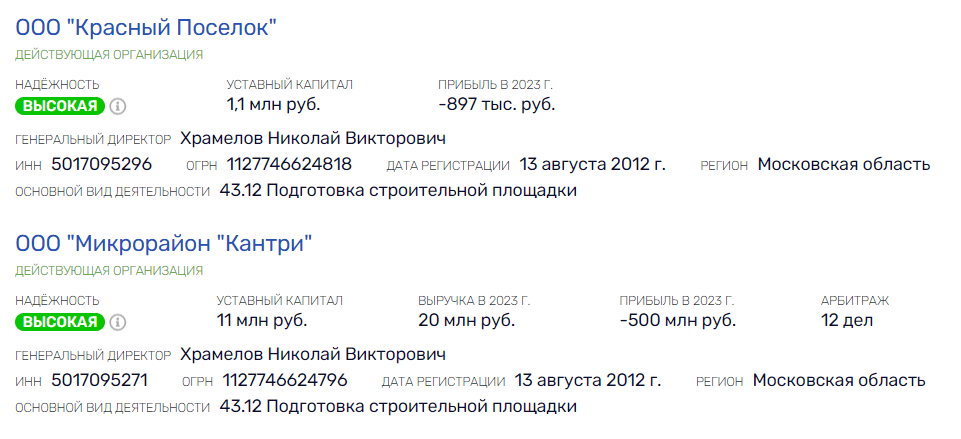

The owner of Obushkovo LLC is Evgeny Lashkov, New Jerusalem is Yulia Chubarova, and Red Village is Nikolai Khramelov. It was the latter that could play a key role, because he is also the owner of the developer "Microdistrict Country," where the largest "hole" in finance is observed. On it, Khramelov, another company in the Istra GO - P.N - Development LLC, is engaged in the provision of accounting services. Apparently, they know how to count badly (or, conversely, well) - the value of assets is minus 75 million rubles.

Photo: Rusprofile.ru

Land is registered for the above companies and there are long-term obligations taken to purchase this land. In a place with the fact that another structure could participate in a possible scam.

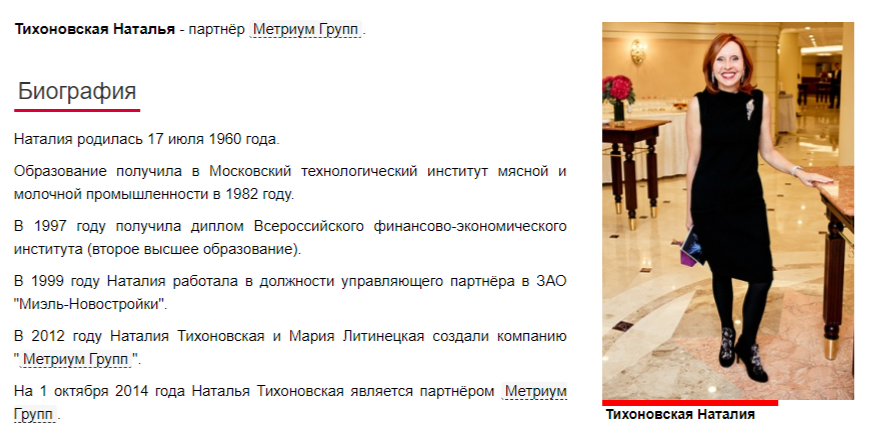

The direct seller of the first stage houses was Metrium. The controlling stake belongs to the Moscow realtor Natalia Tikhonovskaya. Previously, she worked as a managing partner of the Miel development group. Subsequently, its founder Grigory Kulikov was detained on suspicion of fraud in the construction of the cottage village "Barvikha Village" in the amount of almost 86 million rubles.

Natalia Tikhonovskaya. Photo: https://www.tadviser.ru/index.php/Персона: Tikhonovskaya _ Natalia

Subsequently, the structure itself claimed that there was no fraud, and the situation was the result of a corporate conflict at Miel, in which the management accused Natalia Tikhonovskaya. The management claimed that Tikhonovskaya stole more than 2 billion rubles, and a criminal case was opened against her, and Kulikov’s case was ordered.

Considering the above, it turns out that all those involved could have earned on a development project in the Istra region, except for Zenit Bank, which will be credited with losses after the sale of land? In 2017, 62% of the bank belonged to Tatneft, almost 9% of Tatneft Oil AG. That is, given the credit debts of the selling companies of the site, the state remained in the red. Why is Zenit in no hurry to write a statement to the authorities? Probably, the heads of the organization could also be the beneficiary of the alleged "schematosis."